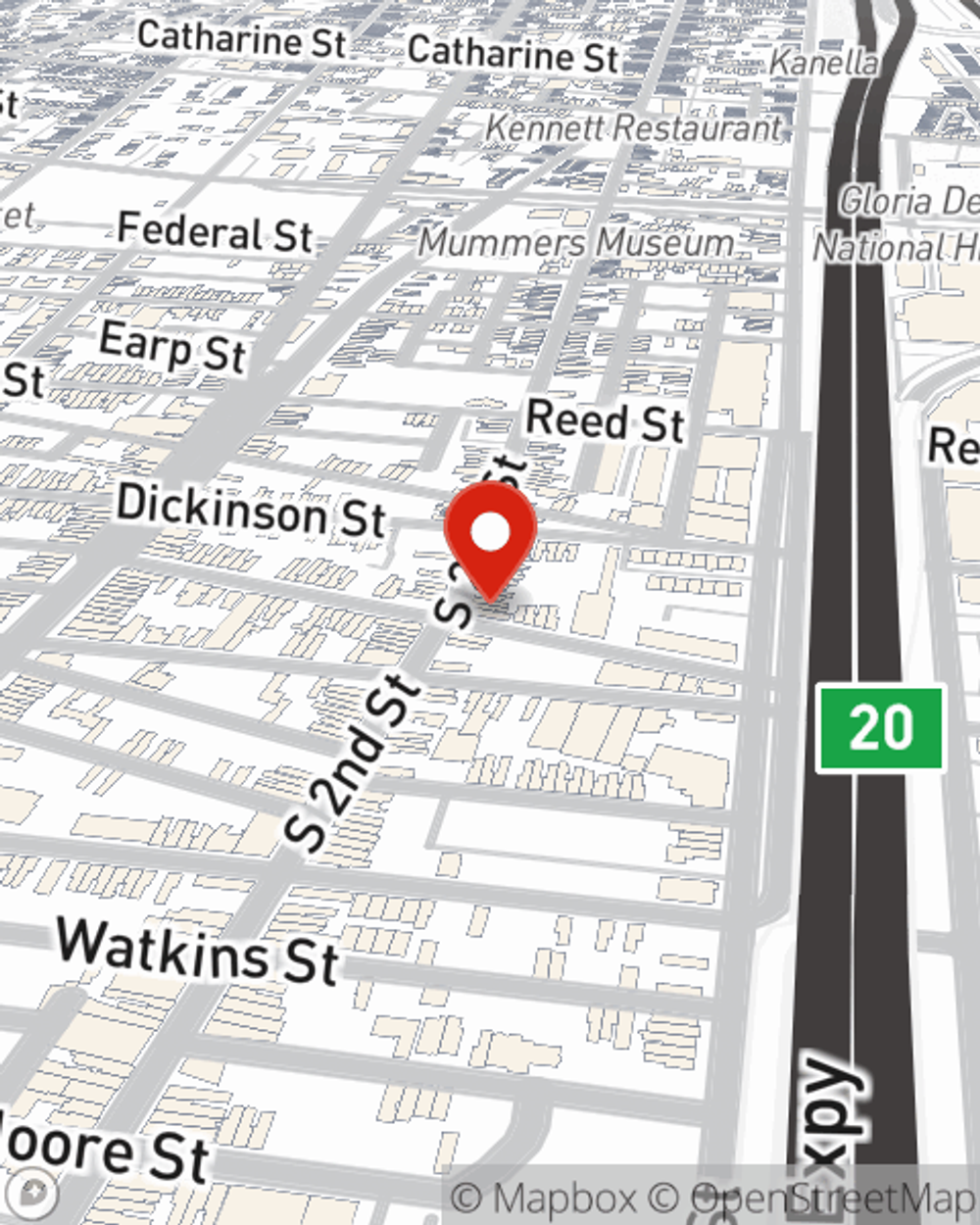

Condo Insurance in and around Philadelphia

Looking for excellent condo unitowners insurance in Philadelphia?

Protect your condo the smart way

- South Philly

- Center City

- Whitman

- Pennsport

- Queens Village

- Society Hill

- Old City

- South Jersey

- Pennsylvania

Welcome Home, Condo Owners

Investing in condo ownership is an exciting decision. You need to consider needed repairs your future needs and more. But once you find the perfect condominium to call home, you also need dependable insurance. Finding the right coverage can help your Philadelphia unit be a sweet place to call home!

Looking for excellent condo unitowners insurance in Philadelphia?

Protect your condo the smart way

Why Condo Owners In Philadelphia Choose State Farm

With this coverage from State Farm, you don't have to be afraid of the unanticipated happening to your unit and personal property inside. Agent Jim Masino can help lay out all the various options for you to consider, and will assist you in constructing a terrific policy that's right for you.

Want to learn more about the State Farm insurance options that may be right for you and your unit? Simply reach out to agent Jim Masino's team today!

Have More Questions About Condo Unitowners Insurance?

Call Jim at (215) 271-6030 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.